CBB 2022 Year-End Budget Review

Posted by admin on

The year 2022 has come and gone and brings our CBB 2022 Yearly Budget Review Report.

Below, I will use a Sankey chart to show you where our money went in 2022.

What I like about the Sankey budget review chart is how easy it is to read.

Also, it allows us to see which budget categories need some help in 2023.

I don’t think we did awful, but we can work on small changes to balance our budget evenly.

Given the rise in prices, especially groceries and utility costs increased, which has affected all Canadians.

Let’s look at our year and then final budget review reports from our last four 2022 Budget Challengers.

2022 CBB Budget Review Sankey Chart

I used a Sankey chart to conduct our yearly 2022 Budget Review to see where our money went and what budget categories did well or suffered.

Moving forward, I will work on this chart as this is my first time using it. I want to colour coordinate each section; for example, Savings will be all green.

Main Budget Review

- Allowance – spent $25.12 over budget.

- Christmas – P/E is $1200, and we spent $295 because we added the groceries into the grocery budget below, and we used PC Optimum points to buy our son a PS5.

- Clothing $3301.02 for 2022 is way off our $100 PE x 12 = $1200. We spent $2101.02 over budget on clothing. Our son’s clothing is harder to find second-hand, so we buy ahead during online sale events from Sport Chek and DSW Shoes Canada. My wife had to buy new clothes because she put on weight after new meds that increased weight due to injury. I mainly bought jeans, socks, and boots a few times throughout the year, only when they were on sale from Marks Work Warehouse.

- Electricity/Water 2021 $244.45 vs. 2022 $326.04 $2678.70/year 2022

- Gas 2021 $29.32 vs. 2022 $76.75, spending $912.63 2022.

- Gasoline 2021 $120.38 vs. 2022 $139.53 $2749.73 /year 2022

- Grocery 2021 $434.68 vs. 2022 $944.58 $11,817.54/2022 or $984.95 monthly 2022 $8400 was the 2022 target which we overspent by $3417.54

- Health and Beauty 2021 $65.67 vs. 2022 $120.73 $2316.63 or $193.05 monthly 2022

- Prescriptions 2021 $23.74 vs. 2022 $28.57 $1492.89/12= $124.40 monthly 2022

- Kids 2021 $16.99 vs. 2022 $142.32 $2206.92/12 = $183.91 monthly 2022

- Misc 2021 $355.99 vs. 2022 $344.09 $4479.59/12= $373.29 monthly 2022

- Telecommunications $1416.11 or +/- $145.75 monthly in 2022 as we dropped our Rogers home phone and cable but added Spotify and Freedom Mobile and, near the end, added 5 GB of data to Mrs. CBB’s phone for $35/month with instead of $25.

- Healthcare 2021 $5 vs. 2022 $73.50 $774.07/12= $64.50 monthly 2022

- Pet cat has eaten a big part of his budget due to his picky eating and needs speed play to get its wiggles out. We have spent money on his regular vet visits but also on toys. Our cat never stops and wants to play from the time he is awake until bedtime. He has enough toys now, so hopefully, that’s all we need to blow on him. 2021 $136.11 vs. 2022 $77.14 $1069.89/12 $89.15 monthly 2022 includes pet insurance.

Budget Overview

Our grocery budget needs a massive overhaul in 2023, as it blew up last year.

Going back to basics will be our motto. We will utilize coupons, printable coupons, online coupon apps, reduced product racks, flyer sales, and Flashfood App better than we did in 2022.

To start the grocery year off on a good note, we bought two turkeys for $0.99/lb at Zehrs to make soup and other meals to reduce meat costs.

Other expenses, such as prescriptions and utilities, have increased, so that we will adjust our budget accordingly.

I hope to spray-insulate the attic in our walk-in closet and our son’s room on the upper level.

Our friends had it done, and their house is toasty warm and confirmed that their heating bill had been reduced.

We’re also getting estimates on windows for our house, starting with a company called Magic Window. If any of you have these windows installed, I’d love to hear from you.

Healthcare Expenses

Lastly, since our son’s autism diagnosis, we have been paying out of pocket for any costs not covered by my employee health plan.

Unfortunately, it takes forever to get financial assistance, perhaps years, but we aren’t waiting for the government to help our son.

In 2022, we spent thousands on his vision care therapy and will start after his therapist returns from maternity leave. Costs for vision therapy can run close to $8000 a year.

Projected Expenses Budget Review

- Birthdays budgeted $50/mth or $600/yr spent $1260.59 OVER by $660.59

- Christmas budgeted $100/mth or $1200/yr spent $295 or $905 under budget but likely went to alcohol and grocery, which I forgot to separate this year.

- Holidays budgeted $100/mth or $1200/yr spent $0 saving up for Europe.

- Home Maintenance budgeted $500/mth or $6000/yr spent $15,773.07/12 $1314.42 monthly 2022 or $9773.07 over budget.

- Licence Renewal budgeted $10/mth or $120/yr spent $10 came in under budget.

- Memberships and Clubs budgeted $100/mth or $1200/yr spent $352.81 came in under budget by $847.19

- Parking budgeted $45/mth or $540/yr spent $873.88/12=$72.82 2022

Changes To Projected Expenses 2023

There are three projected expense categories that we need to look at for 2022.

- Birthdays we didn’t consider birthday parties our son would attend, which we will estimate for 2023. We also went a bit overboard buying for each other, and there’s no excuse apart from the fact that we need to do better. There will be an increase in projected expenses for 2023.

- Home Maintenance is always a tough one for us since we have the money saved to do the projects. In 2022 our most significant projects were the master bathroom and the main bathroom, which were gutted and redone. Since we haven’t met our yearly goals for renovations, this didn’t make a huge difference for us.

- Parking costs have increased as I pay to park with my employer to over $500 a year. Plus, we spend $100 on 10 parking passes for my wife to go to the hospital, which is cheaper than hourly payments of $15. Any other parking fees we pay throughout the year are random. We will estimate our projected expense higher for parking in 2023.

New Projected Expenses

In addition, our projected expenses will include passports, photos, and permanent resident card fees.

Mrs. CBB has two passports, one for Canada and another which was EU but now for her family’s homeland.

She had to pay for translations of her documents, order long-form documents, postage, petrol, and parking fees to visit the consulate.

I’m considering getting our son dual citizenship for the UK, which costs about $2000, and lastly, becoming a Canadian citizen myself.

Investing

Currently, our investments for 2023 will stay the same apart from our Tax-Free Savings Account, which will increase by $1000 or $500 each.

The maximum allowable TFSA deposit for 2023 is now $6500, up from $6000 in 2022.

I’ll start a percentage update for 2023 instead of a net worth update. I’m sure none of you care any longer since we aren’t in debt.

Currently, our investments are invested in an aggressive model portfolio with Manulife.

Before the 2022 RRSP season deadline of March 1, 2023, I’ll be moving $16,000 into my investments using the available contribution room.

I’ve been watching the markets and will decide closer to the date as I have excess investment room to use.

Timing the markets is not advised, although I was hoping to take advantage of the lower prices just in case the market did go up.

Lastly, I’m waiting for information to open our son’s Disability Tax Credit.

Family Budget Report For December 2022

December Budget Summary

Like most people, December was a busy month for finances with Christmas and New Year’s celebrations.

We were supposed to host Christmas Eve dinner, although that didn’t work out because of the snowstorm.

I spent a bit more than anticipated at the LCBO because I didn’t have a plan before I went in.

I will be working on that for the 2023 holidays, so I don’t spend a fortune.

Like everyone else, we’ve also noticed a spike in our gas, electricity, and water bills.

I assume these costs will continue to rise as we’ve been told they would.

Also, I purchased some gadgets to ensure my truck doesn’t get stolen, as there has been a theft ring in our area.

In my new blog post about protecting your vehicle from theft, you can read more about this story.

Budget Expenses Percentages For December 2022

Our savings include investments and any savings for this month based on the net income of $11,992.09

Equally important is that we save money on our projected expenses due in the coming months.

All categories took 100% of our income, showing that we accounted for all the revenue in December 2022.

This type of budget is a zero-based budget where all the money has a home.

Year To Date Percentages 2022

Monthly Home Budget Breakdown

Below is a breakdown of our expenses which helps us understand where our money goes.

- Chequing– This is the bank account from which we pay our household bills. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about the best Canadian online virtual banks.

- Emergency Savings Account– This money is in a high-interest savings account (HISA)

- Regular Savings Account– This savings account holds our projected expenses.

- Monthly Budgeted Total: $6564.18

- Monthly Net Income Total: $11,992.09

- (Check out the Ultimate Grocery Guide to see where our grocery money goes)

- Projected Expenses: These are expenses we know we will pay for throughout the year = $852.91

- Total Expenses Paid Out: $7813.93

- Total Expenses Paid Out: Calculated is $11,992.09 (total net monthly income) – $852.91 (projected expenses) – $3,325.25 (Savings to emergency fund) = $7813.93

- Actual Cash Savings going into Emergency Savings: Calculated is $11,992.09 (total monthly net income) – $7813.93 (actual expenses paid out for the month) – $852.91 projected costs) = $3325.25

Estimated Budget and Actual Budget

Below, you will see two tables: Our monthly and actual budgets.

Our monthly budget represents two adults and an 8-year-old boy.

Budget Colour Key: It is a projected expense when highlighted in blue.

Since May 2014, we’ve been mortgage-free, redirecting our money into investments and renovations.

Spending less than we earn and budgeting has been the easiest way to pay off our debt and save money.

Monthly Budget Amounts December 2022

Actual Monthly Budget December 2022

I’ll be back in February 2023 to share January 2023 Budget Update and close off the year.

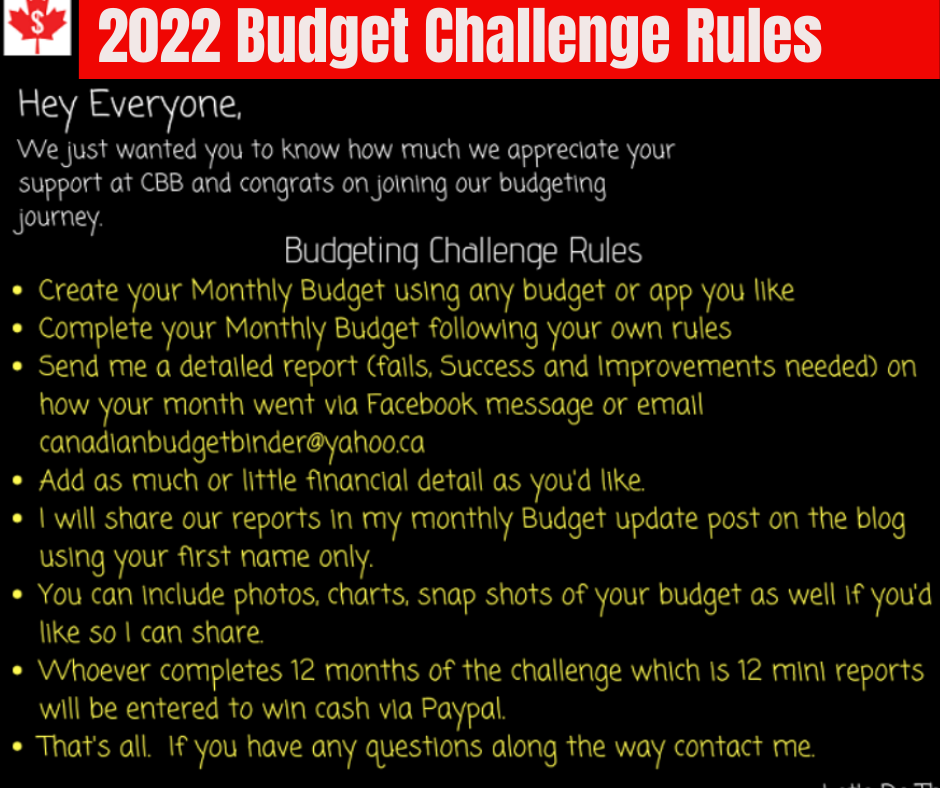

Below is the final month of the 2022 Budget Challenge.

I’m proud of the final four who completed 12 months of budgets.

Please leave them a comment below to support their success.

Congratulations, ladies, and I hope you continue to budget your way to financial success.

You will receive a $25 President’s Choice Gift Card for participating.

Mr. CBB

2022 Budget Challenge Canadian Budget Binder

Budget Challenger #1

- Income Dec 3, 1110.98 Dec 17, 1163.18

- Spousal support 700

- Sarcan 10

- Vs cell 95

Total Income = 3,079.16

Expenses

- Income tax 100

- Car insurance 75

- Car repair 0

- Cells 266.26

- Elect/water/power 253

- Tfsa 500

- Rrsp 250

- Crave 16.70

- Wifi 80

- Gas 110

- Groceries 450

- Home Insurance 110

- Alarm 54 33

- S.p.p. 50

- Water softener 30

- Water heater/ac/furnace 188

- Life insurance 75

- Lotto 7.50

- Entertainment 80

- Mortgage 560

- Parking 45

Total expenses = 3,800.79

Total Income 3,079.16–Total expenses 3,800.79

= -721.63

If I calculate last month’s-337.04 and add this month’s of – 721.63 = -1058.67

December Budget Review

Well, December didn’t end in a positive financial situation.

I try so hard, and I fail pretty near every month.

I’ve been decluttering, making myself feel better, and talking to my son AGAIN about my finances.

I’m supposed to get a raise of $1.30 per hour sometime soon, which I look forward to.

I received the good news that my car insurance was reduced to 75 dollars.

That’s a 15-dollar saving per month!

This year has been challenging because everything I get ahead, something always happens.

For January, I have some thinking to do about my budget.

I contemplated quitting budgeting, but I know if I do, it will only get worse.

It’s hard to see the cold truth, but I will not give up.

2023 budget, hear me roar.

Budget Challenger #3

Hi Mr. CBB,

We were in the minus this month due to the last of Christmas gifts.

Amazingly, we rescued a cat from the shelter resulting in pet costs increasing for the month and a couple of extra mortgage payments from bi-weekly.

We will receive our Health Spending reimbursement in early January for the receipts we could not submit since October as we hit our spending cap. I did add this in the December column as it was 2022 money spent.

Overall for the year, we were short -$473.09. I am impressed, and it sure could have been worse. And, yes, we have improvements we want to work on for 2023!

I was excited to complete an entire year of tracking, even if it wasn’t perfect every month.

2023 Budget Goals

- Put rental incomes into a separate account and move over rental mortgage payments from that account. Once that reaches a certain amount, the excess can go to debt repayment (from the renovation of the secondary suite in 2020). Also, track this separately from our day-to-day banking. Property management provides a breakdown monthly for repairs and service fees to track. For 2022 we only tracked the positive amount that was deposited each month.

- Get grocery/daily household items down to $1000/month

- Keep current home maintenance down (only do what is required when needed)

- Continue to pay off HELOC from suite renovation: The goal is $500 per paycheque

- Put away $200/month for summer travels

- Add a thrift store category (I am addicted, and it gets shuffled into clothing/large household or miscellaneous)

- Split Entertainment into Adult and Family/Kid categories

Thank you Mr. CBB for keeping me motivated to stay on track.

I am excited to implement the changes to our 2023 budget, and my hubby feels better now that our yearly was reasonably balanced.

Final Budget Review 2022 December

| Default Values | November | December | ||

| Income | ||||

| Expected | $ 13,029.77 | $ 15,951.00 | $ 14,917.00 | |

| A-Pay | $ 4,866.44 | $ 5,477.60 | $ 5,461.21 | |

| K-Pay | $ 3,300.00 | $ 6,524.02 | $ 4,355.49 | |

| CTB | $ 354.99 | $ 293.89 | $ 293.89 | |

| Bluecross reimbursement | $ 285.00 | $ 1,448.24 | ||

| 1st rent | $ 1,650.00 | $ 2,066.70 | $ 2,140.38 | |

| 2nd rent | $ 850.25 | $ 939.75 | $ 835.90 | |

| 3rd rent | $ 1,123.09 | $ – | $ 530.16 | |

| 4th rent | $ 600.00 | $ 650.00 | $ 650.00 | |

| Actual Income | $ 13,029.77 | $ 15,951.96 | $ 15,715.27 | |

| Expenses | ||||

| Charity | $ 50.00 | $ 50.00 | $ 65.00 | |

| TFSA | $ 325.00 | $ 425.00 | $ 425.00 | |

| Internet | $ 49.30 | $ 49.30 | $ 49.30 | |

| Streaming | $ 20.98 | $ – | $ – | |

| Electricity/Water | $ 250.00 | $ 189.54 | $ 184.33 | |

| Natural Gas | $ 250.00 | $ 76.33 | $ 163.77 | |

| Cell Phone | $ 40.95 | $ 40.95 | $ 40.95 | |

| Fuel | $ 280.00 | $ 240.01 | $ 365.05 | |

| Vehicle Maintenance | $ 881.45 | $ 362.75 | ||

| Parking | $ 4.00 | $ 5.75 | $ 9.00 | |

| Groceries/Household | $ 1,100.00 | $ 911.71 | $ 1,187.73 | |

| Restaurant | $ 200.00 | $ 379.00 | $ 328.63 | |

| Liquor Store | $ – | $ 75.00 | $ 55.99 | |

| Clothing | $ 75.00 | $ 157.80 | $ 311.00 | |

| Fun Money | $ 400.00 | $ 400.00 | $ 400.00 | |

| Hair/Cosmetics | $ 30.00 | $ 45.41 | $ 89.77 | |

| Professional fee | $ 35.00 | $ 35.00 | $ – | |

| Kids Toys | $ 40.00 | $ 155.56 | $ 78.00 | |

| Large Household | $ 250.00 | $ 679.44 | $ 120.16 | |

| House Maintenance | $ 100.00 | $ 54.43 | $ – | |

| Childcare | $ 950.00 | $ 822.00 | $ 603.00 | |

| Pet Care | $ – | $ – | $ 674.61 | |

| Miscellaneous | $ 100.00 | $ 410.84 | $ 873.44 | |

| Maid service | $ 108.00 | $ 108.00 | $ 162.00 | |

| Entertainment | $ 100.00 | $ 124.85 | $ 73.00 | |

| Travel **A&M-taxes | $ 300.00 | $ – | $ – | |

| Gym/Pool | $ – | $ – | $ 378.00 | |

| Massage/Chiro | $ 200.00 | $ 350.00 | $ 560.96 | |

| Bank Fee | $ 16.95 | $ 16.95 | $ 16.95 | |

| Life Insurance | $ 230.93 | $ 230.93 | $ 230.93 | |

| Auto Insurance | $ 173.81 | $ – | $ – | |

| Home Insurance | $ 673.60 | $ 322.74 | $ 677.92 | |

| Total expenses | $ 6,353.52 | $ 7,237.99 | $ 8,487.24 | |

| Debt | ||||

| LOC | $ 1,500.00 | $ 1,350.00 | $ 2,900.00 | |

| HELOC | $ 157.85 | $ 315.84 | $ 389.06 | |

| Mortgage 1 | $ 886.84 | $ 909.00 | $ 1,136.19 | |

| Mortgage 2 | $ 908.16 | $ 1,123.23 | $ 748.82 | |

| Mortgage 3 | $ 1,021.18 | $ 1,021.18 | $ 1,021.18 | |

| Mortgage 4 | $ 1,556.94 | $ 1,612.98 | $ 2,419.47 | |

| Total Debt | $ 6,030.97 | $ 6,332.23 | $ 8,614.72 | |

| Every Dollar App Total | $ 645.28 | $ 2,381.74 | -$ 1,386.69 | -473.09 |

Budget Challenger #4

Happy New Year, CBB!

2022 was not the first year that I’ve tracked my spending, but it was the first time I let anyone else see it. Yes, it was a simplified version, but it was still scary putting it out there.

Looking at December’s numbers, food spending is still off the charts, even with the budgeted increase. Part of that was holiday-related, but I want to work on it for 2023.

You’ll see condo fees were identified in the budget column, with a note in the Actual column that the condo fees money is in the other account (different bank).

Instead, the equivalent amount to the condo fees was deposited to the Health/Glasses account.

Rest assured; my condo fees are getting paid.

The budget challenge has made me aware of things I do that don’t necessarily make sense to other people but are essential for me.

For example, putting money into Projected Expense accounts while I’m taking money from other PE accounts.

Some of those things make my credits/debits look inflated, but it works for me and that’s all that matters.

2023 Budget Goals

What does 2023 hold for CBB Challenger 4?

I’m starting an assignment that includes a small raise, which should cover the budget shortfall I anticipated in some months.

I’ll have a minor dental procedure in Jan/Feb (hurray for Projected Expense accounts!), and then I can start directing money toward the vacation fund for Christmas 2024.

Trying to work my way through the stash of fabric, yarn, and craft supplies that fill my craft closet so that I can be creative but budget-conscious.

Living my best, frugal-est life under the Midnight Sun.

Thanks for a great year, everyone!

Budget Challenger #5

Another year has come and gone, and unfortunately, my boyfriend wasn’t working.

At first, this didn’t impact much, he had savings which he used sporadically throughout the year, and I covered more of the bills than I normally would, but he ran out of savings in November.

The closer we got to November, the more of a pinch I felt financially, but it’s not too bad yet. We can continue to make it work if he doesn’t return to the workforce.

It’s nice having him at home to deal with any issues, and he does the cooking and cleaning.

I’m okay with things right now, but it does hurt seeing that I can’t put as much money away for savings/vacations.

I was super lazy this year and didn’t put my numbers in my excel spreadsheet, so I don’t have quick access to my yearly totals, but from what I remember saying, most months, fast food is what will get me.

We eat well while I’m home, but we never seem to have leftovers, so lunches are always me going out and buying things.

It’s super hard not to do it, too, because I work directly in the center of about 14 fast-food/restaurants.

In December, I spent a lot -some purposefully (doing last-minute orders for work that I will be reimbursed for in January.

I don’t mind doing this as it gets me Airmiles or rewards of some kind with my credit card) but other things, I don’t understand how they added up so high!

Budget Review December 2022

- Work: Paid for Xmas dinner – 357.70 + Bought office supplies – 702.47

- Groceries: 543.32 – I’m stunned by this one; I don’t remember ever going this high. Our father-in-law is staying with us, so maybe that had something to do with it. Honestly, though, I think it is just the cost of groceries right now.

- Entertainment 26.43

- Phone 183.34 – about $110 higher because I pay to have a data package on it when I am in the US, and my trip was last month. It did go up $2 a day from the last time I used it, which sucks!

- Gifts 357.88

- Investments 200

- Insurance 168.92

- Gas 351.39 – again, I don’t remember my gas being that expensive in one month, but I did a lot of traveling for work and Christmas. Luckily I’ll get most of that back from my work as we have mileage claims for when I get sent to another office.

- Pet 51.73

- Fast Food 151.74 – some of this was while we were in another province for Christmas, so I don’t feel as guilty about it being as high as it is.

- Internet 110

My big worries for next year are if the car dies – it is so hard to find a vehicle right now!

Also, I need to get the septic pumped, and there was an issue last time.

I’m hoping it won’t end up being anything, but there will be a problem with a big expensive fix – we shall see!

I hope everyone is doing well, and happy 2023!

Subscribe To Canadian Budget Binder

Get CBB By Email + My Free Printable Budget Binder!

The post CBB 2022 Year-End Budget Review appeared first on Canadian Budget Binder.